Intent Detection is a critical feature used to analyze and identify underlying intentions behind customer queries. It matches these questions with the respective actions, making conversations more contextual, natural, and actionable.

Consider the diverse nature of banking queries, from basic account opening inquiries to complex issues like transaction disputes or loan eligibility questions.

Adding every customer query in the UI is an option, but it makes the UI unnecessarily complex. And it fails to address specific customer circumstances or understand the nuances of their queries.

Intent Detection, however, can adapt to the diverse range and complexity of these queries. It leads to empathetic understanding, mimicking the nuanced communication of human interaction.

Intent Detection, however, can adapt to the diverse range and complexity of these queries. It leads to empathetic understanding, mimicking the nuanced communication of human interaction.

How Intent Detection Works?

Intent Detection operates by intricately analyzing a user’s input, focusing not just on the words but also on the context and underlying meaning.

This process involves sophisticated AI models or LLMs trained on extensive datasets, enabling them to interpret linguistic nuances and patterns.

When a user submits a query, these models break down the text to extract its semantic essence. It then expertly matches this output to a range of pre-defined intent categories, ensuring that the response aligns accurately with the user’s needs.

For instance, if a banking assistant is fine-tuned using a dataset specific to banking queries, it becomes more adept at discerning and responding to a wide range of customer queries.

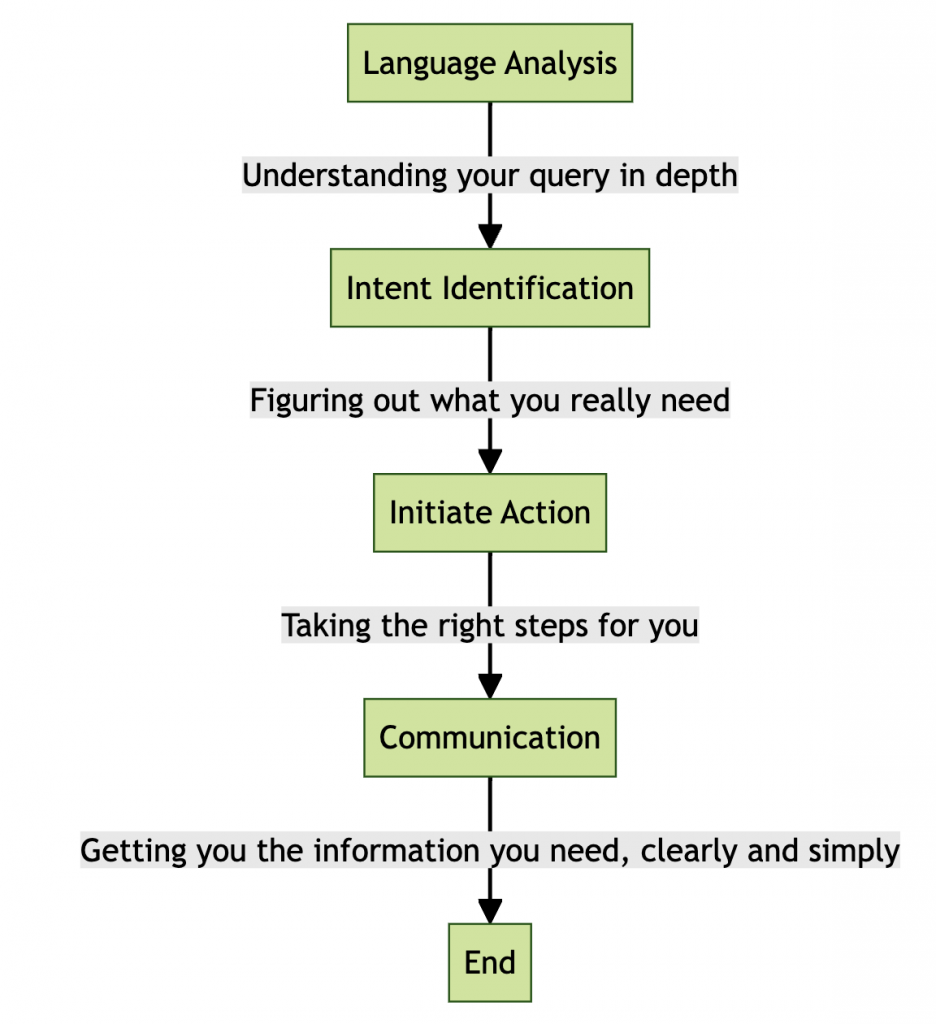

If a user asks, “What’s my credit score?” here’s how the Intent Detection workflow would unfold :

- Language Analysis: The system employs sophisticated algorithms to dissect the query beyond basic parsing. It assesses sentence construction and key phrases, utilizing context-aware techniques to grasp the subtleties in language.

- Intent Identification: The system accurately discerns the user’s intent by leveraging a model fine-tuned with a specific banking dataset. It understands complex queries, such as those related to credit scores, through nuanced pattern recognition.

- Initiate Action: After identifying the intent, the system aligns it with a respective action. This step involves selecting the most appropriate information or action, such as linking to credit score services or providing detailed steps for credit score access.

- Communication: The final step involves delivering the response clearly and concisely. The system ensures that its communication is precise and on point, mirroring the expertise of a skilled bank representative.

Simplifying Intent Detection with TARS

Consider the range of customer interactions that support teams encounter daily.

Each of these interactions has unique subtleties of their own.

An inquiry that initially seems straightforward, such as a routine account check, may signify deeper concerns about financial security. Similarly, mortgage discussions often transcend mere rate queries, touching on personal aspirations and significant life decisions.

Understanding these subtleties is crucial yet challenging. It demands a refined interpretation of customer needs, a skill typically honed over years of experience. However, even seasoned professionals are not immune to biases and misinterpretations.

Even minor misunderstandings can erode customer trust and tarnish the organization’s reputation in high-stakes sectors like banking or finance, where precision and trust are non-negotiable.

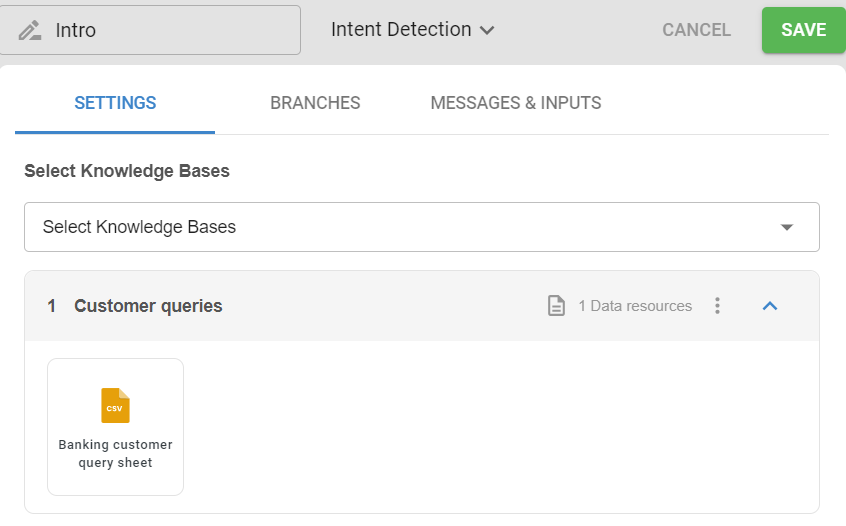

At TARS, we aim is to demystify and streamline this intricate process for businesses. We have developed a robust product with Intent Detection built into the core, tailored for businesses that may need deeper expertise in this arena.

- Our system, seamlessly integrated into client dashboards, is designed to adeptly handle conversational dynamics with customers. It prioritizes functionality through precise, to-the-point responses while maintaining consistent user experience in real-world settings.

- Moreover, TARS utilizes extensive knowledge bases to map customer queries accurately to the most relevant intents. By training our system on diverse and comprehensive datasets, we ensure that it can recognize and categorize a broad spectrum of customer inquiries.

This approach bolsters the accuracy and relevance of responses, enhancing the interactive experience as a whole.

Applications in the Banking Industry

To illustrate the practicality of TARS in real-world scenarios, consider these examples in the banking sector:

| Customer Question | Matched Intent | Actions |

|---|---|---|

| “What’s my current account balance?” | Account Balance Inquiry | TARS retrieves the current balance and summarizes of recent transactions, providing a comprehensive overview. |

| “Can you check my last five transactions?” | Account Balance Inquiry | TARS provides details of recent transactions as part of the account balance inquiry for thorough customer understanding. |

| “I see a charge I don’t recognize; what do I do?” | Fraud Reporting | TARS initiates a fraud investigation process to address suspicious account activity. |

| “I suspect someone has accessed my account.” | Fraud Reporting | TARS responds to potential unauthorized access by starting a fraud investigation. |

| “How can I apply for a personal loan?” | Loan Application | TARS guides customers through the loan application process, simplifying banking procedures. |

| “What are the requirements for a mortgage application?” | Loan Application | TARS provides information and guidance on the mortgage application. |

| “There’s a wrong charge on my card; help!” | Transaction Dispute | TARS starts the dispute resolution process to address the transaction dispute. |

| “I disagree with a transaction amount; what should I do?” | Transaction Dispute | TARS efficiently handles the customer’s concern by initiating the dispute resolution process. |

Get started with Generative AI and Intent Detection

Intent Detection leverages advanced AI to promptly grasp the user’s context, providing a clear and structured guide to address their specific needs.

This efficient understanding of user intent empowers businesses to respond to customer queries accurately, enhancing customer satisfaction and engagement.

To get started with intent detection, book an AI consultation with us today.

Vyshnav is a writer and editor who’s been creating written and multimedia marketing content for agencies and businesses since 2018. His work spans multiple industries, but has ultimately led him to focus on conversational AI as a core niche.

Vyshnav writes and manages different types of content for TARS, particularly in automation & customer experience domains for BFSI.

In his spare time, you can either find him busy with ancient scriptures or trekking across the western ghats.

0 Comments on "How Generative AI Helps in Understanding Customer Intent"