What is InsurTech?

Think of the insurance industry as a friendly neighbour who’s there to help when things go wrong. It’s like a big safety net, ready to catch us if we fall. But the tricky part? Most people don’t see the value of this safety net until they are tumbling down. Selling insurance isn’t like selling a car or a phone. It’s selling a promise, a trust that help will be there when you need it.

Buying insurance should be a big deal for everyone, but often it’s pushed to the side until something bad nudges us. The old saying goes, insurance is sold, not bought. That’s where insurance agents come in, helping us understand why insurance is a friend we need. When this friendship blooms, it’s a win-win. But, if trust fumbles, especially when claims turn into a hide-and-seek game, doubt creeps in. Over time, a blurry line between need and trust has grown, making insurance seem more like a grumpy gatekeeper than a helpful neighbour.

Some folks even dance on the edge, buying insurance with sneaky plans up their sleeves. The corporate higher-ups too, sometimes hand over the insurance shopping list to the newbie on the team, making the whole thing a tick-box task rather than a thoughtful choice. This casual toss of responsibility, mixed with a cocktail of misunderstandings, often leaves everyone in a pickle when trouble knocks on the door. And while insurance has been playing hide in the shadows, its charm is fading, especially in places where it’s just starting to wave hello.

Also, folks selling insurance have been stuck in old ways while the world raced ahead with new gadgets and apps. They missed catching up with the digital train, making their methods look like an old hat. This isn’t just about keeping up with trends; it’s about keeping the trust alive. When selling gets driven by fear or the systems remain outdated, people start doubting the promise.

InsurTech

Here comes a new wave, the InsurTechs, bringing a sparkle of hope to the old-school insurance arena. They are like the much-needed rain that brings a promise of a lush, green garden. By marrying technology with insurance, they are rekindling trust, making the promise not just shiny but solid. They’ve stepped onto the field with a new playbook, aimed at making the safety net not just sturdy, but clear and easy to grasp.

But this isn’t merely a superficial makeover. It’s like swapping out an old, worn-out battery with a fresh, fully charged one that’s ready to power up a gadget to its fullest potential. It’s about adjusting the insurance industry to the quick pace of the digital age, making sure the safety net is not just in place, but strong and ready to provide a comforting hold when things go south. Through the lens of InsurTech, this article helps traditional insurance players see how they can make their services better with digital tools. It shows a simple path to start using technology in a way that’s easy to understand and follow. Stepping into the next sections, we’ll see how boosting our use of technology, clearing up how things work, speeding things up, and tightening security can make insurance better and easier for everyone.

InsurTech Increases Technology Use:

The insurance world seems to be trailing a bit when it comes to hopping onto the technology bandwagon. While other financial realms have embraced the digital age, insurance still has a fondness for the good old face-to-face interactions. People seem to seek a human connection, especially when contemplating the rainy days ahead. But, it’s about time we warm up to the digital tools around us, making the process swifter and smoother.

InsurTech Improve Transparency:

The insurance sector has a bit of a foggy atmosphere when it comes to showing how the money moves. Who gets what piece of the cake often remains a mystery, and that’s a tune that’s been played a bit too long. This lack of clear view has stirred some negative chatter. It’s time to clear the fog, let the sun shine on the process, and allow a glimpse into the workings, fostering a bond of trust with those we serve.

InsurTech Speeds Up Processes:

Time seems to have a leisurely stroll in the insurance corridors. Whether it’s getting insured or filing a claim, the journey feels like a slow dance. The extensive paperwork could test anyone’s patience. A dash of speed, reducing the long waits and making the steps less of a chore, can surely paint a more pleasant picture.

InsurTech Boosts IT Security:

Our digital house seems to need a better lock. Compared to other sectors, our data protection gear isn’t as tight. There have been tiny pebbles of data loss rolling, hinting at a need for stronger defenses. Before a larger storm hits, it’s wise to fortify our data walls, keeping the trust intact and nightmares at bay.

Digital Transformation with InsurTech

Transformation for Transparency

Informed Buyer: Once upon a time, shopping was a bit like hunting for treasure without a map. You’d go to your local shop, chat with the seller, and make a choice based on what was in front of you. But oh, how times have changed! Now, it’s like having a magic mirror that shows you all you need to know, anytime you ask. With a few taps, you can compare prices, read what other folks think, and make a choice that fits just right. It’s like going from a small window to a big wide door that opens up a world of choices.

Insurance Transformation: Now, this wave of change is washing over the shores of Insurance Land too. Especially when talking about things like property or accident insurance, the landscape is shifting from a maze to an open field. Before, the path was dotted with middlemen who’d help you find your way, but now, you can take the reins and steer your own course. With more information at your fingertips, like what other customers say or how different offers stack up against each other, making a choice feels less like a gamble and more like a well-thought-out decision.

Transparency Trend: Sites like MoneySuperMarket are like friendly guides in this new journey, helping you compare and choose with ease. Even the tricky trails of complex insurance are getting a sprinkle of simplicity, making the unknown a bit more known. This new rhythm of transparency isn’t just a fleeting tune, it’s becoming the beat that drives the market. For instance, buying car insurance has transitioned from a slow stroll with an agent to a swift online sprint. This clear view is like a fresh breeze that’s making the insurance market a friendlier place to be, shifting the scales towards a world where you, the customer, take the lead in the race.

Transformation to directly connect producer and customer

Direct Connection: Now, online platforms are the new go-betweens, taking the place of the old way of selling and buying. Just like how Amazon and Uber changed the game in shopping and catching a ride, this new trend is making its way into the insurance world too.

Online Shift: In today’s online buzz, buying insurance is getting a new look. Things like social media profiles and quick, easy data inputs are becoming the new way to connect insurers with customers. Gone are the days of long forms and slow processes. Now, buying or cancelling insurance, or even claiming it, is all about quick clicks and real-time updates.

The New Players: New names like Lemonade are stepping into the field, shaking things up with their fresh online approach. Even though the whole scene is changing, customers are catching up fast. The ease and speed of the new way make it a breeze to adapt to.

The Broker’s Role: Even in this digital shift, the human touch isn’t vanishing completely. Sure, for simple stuff, online is king. But when it comes to the more complicated matters like planning for retirement, a trusted advisor is still irreplaceable. The role of brokers is evolving, sticking around to lend a hand when the online world can’t answer all the questions.

Transformation from many high-priced sellers to few low-priced big sellers

Scaled Down, Scaled Up: Digital tools are reshaping the business landscape. They gather heaps of data and automate processes, making it easy for big digital businesses to thrive even with small profits from each sale. This change has nudged aside many small players in various fields like taxi services and fashion retail. These small players used to enjoy a good profit margin thanks to their close ties with customers and lack of competition. However, their total profits weren’t sky-high due to their small scale.

Emerging Giants: With the digital shift, some big players are emerging from the crowd. They build large-scale businesses that pull in big total profits, even if the profit from each sale isn’t much. In the insurance arena, we still have many small players holding their ground. But players like Element and One are stepping in. They are like ready-to-use insurance providers that businesses can plug into their own systems. They focus on the nuts and bolts of insurance, dealing with specialized products and handling the paperwork swiftly.

The Digital Advantage: These newbies use online marketing and competitive pricing to stretch their reach far and wide, although they still need to invest in areas that old players have a strong hold on. The way they operate – transparent, digital, and scalable – sets them apart and could speed them up to the top of the industry ladder. This digital way of doing things needs a fresh approach in how companies are run, organized, and even in the workplace culture. This fresh approach is a strong suit for new players, and a tough nut to crack for the old guard.

Transformation from company-driven to customer-driven focus

Shifting the Spotlight to Customers: The winds of change are blowing, shifting the focus from companies to the very people they serve – the customers. As buying journeys change, insurance companies find themselves stepping into new roles. No longer are they the lone captains, but rather a part of a larger ecosystem, changing the way they interact with customers.

Becoming Supply Factories: In this new setup, insurance providers morph into supply factories, standing ready to meet customer demands at a snap. It’s about being there for the customer, anytime, anywhere, and through any means. Whether it’s through direct sales, branded ecosystems, or being bundled with products like cars and electronics, the approach is all about seamless service. This means a shift from the old ways of push-marketing to crafting offerings from the customer’s viewpoint, making them as tailored as a well-fitted suit.

Evolving Insurance Products: Customers today want more. They crave for insurance coverages that morph as per their needs, be it all-in-one solutions or integration with other services. And in this digital age, safeguarding personal data is paramount. Imagine having a digital vault that stands guard to your identity. This trend is birthing what one might call “security-service-ecosystems”, where the customer’s journey is integrated, doing away with the need for external services. The road ahead for insurance companies? It’s about either weaving in external digital solutions or building their own, all dependent on their resources and the muscle to attract the right talent. This isn’t just a fleeting phase but a fundamental shift, steering the insurance world towards a more customer-centric horizon.

New Insurance Models with InsurTech

The insurance industry, once static for over 75 years, is now bustling with fresh ideas. New models are cropping up, focusing on how policies are distributed, compared, and what they cover. It’s a shift from the old where one often paid premiums without truly grasping the coverage. Now, in different parts of the world, startups are changing the insurance narrative. They are offering group buys, pay-per-mile coverages, and even refunding a part of the premiums. A notable player is London’s Bought By Many (Now Many Pets), which taps into social media and search data to offer insurance for specific needs like pet or gadget insurance. It’s not just about individual buyers; businesses are also on the radar with digital offerings tailored to their unique needs, be it a restaurant or a consultancy.

Insuring Specific Events:

Now, the insurance talk is about covering specific events rather than a broad sweep. It’s a step closer to what one actually needs, making insurance more about the person and less about the policy. With Metromile, if you drive less, you pay less. It’s as simple as that. The shift is from the general to the discrete, focusing on particular life or business events. For instance, should a frequent flyer insure all flights or just those likely to be delayed? Should a car owner seek coverage based on hours driven or miles covered? The innovation extends to business insurance too. Companies like Germany’s Simplesurance and US’s Next Insurance are easing the insurance shopping for businesses, offering a digital platform to compare and choose policies. Even established players like AXA are hopping on the innovative train, partnering with startups to offer more tailored coverages.

Consumer-Defined Insurance:

The new insurance models are about consumer-defined time frames and events. Whether insuring a flight, a car, or personal possessions, the control is swinging back to the consumer. It’s about covering what matters when it matters. Companies are innovating around these needs, offering more choices and flexibility. Even on the business front, the trend is towards insuring specific events that could hinder operations, like certain weather events or security breaches. With tech like big data and analytics in play, insurance is becoming more about mitigating real, tangible risks.

Digital Bridge to Better Coverage:

Technology is the bridge connecting consumers and businesses to better insurance coverage. Startups are not just innovating; they’re digitizing the insurance process, making it less cumbersome and more tailored. They’re helping traditional brokers too. Take Indio, a US-based startup; it created a platform to ease the workflow for commercial insurance brokers, linking them to a digital marketplace. The evolution is clear – insurance is becoming more personalized, more about covering the actual risks one might face, and less about a one-size-fits-all model. With AI and machine learning in the mix, the journey from a fixed premium to insuring discrete events is on a fast track. The future? It’s about more precise, tailored insurance coverages, all thanks to the blend of innovative thinking and tech.

Impact of InsurTech on Jobs

Robotic Process Automation (RPA) and AI have been the talk of the town, and with Generative AI entering the scene, it’s not merely about automating tasks anymore, but envisioning new ways to handle work. This isn’t just a fleeting concern; it’s a narrative of changing job landscapes and the ripple effects on policies and paychecks. Insurance had a head start in embracing technology, but now it’s at a crossroad with outdated systems staring back. InsurTech, with Generative AI in its toolkit, is hinting at a new dawn where the digital and real worlds don’t just coexist but interweave, opening doors to an era where technology doesn’t just support but spearheads creation and innovation. It’s a narrative of not just automating the mundane but injecting a creative flair into old problems, reshaping tasks and the way they are approached.

The spotlight now is on commercial insurance, a domain where simplicity is overshadowed by intricate webs of client needs and relationships. InsurTech aims to unravel the simple, but commercial insurance isn’t a straightforward script. Even as Generative AI churns out smart solutions, the essence of human understanding and relationship-building remains irreplaceable, showcasing a stage where both tech and humans have pivotal roles to play. The slow-paced transition in commercial insurance isn’t a sign of resistance; it’s a narrative that underscores the enduring essence of human interaction. As Generative AI weaves innovative solutions, the human brokers, with their empathy and personalized attention, continue to be the stars of the show. It’s a blend of tech-aided solutions with a human touch that forms the crux of the evolving insurance landscape. Individuals in insurance aren’t just spectators; they need to gear up, hone skills that resonate with creativity and personal insight, dive into the data sea for sharper decisions, and keep a flexible stance in the work arena. With the right attitude and backing from their organizations, they can navigate this unfolding narrative, ensuring the human essence remains the spotlight in a tech-enhanced scene.

Tasks Completely Automated through AI:

Record-keeping: AI can manage and organize vast amounts of data efficiently, ensuring records are accurately maintained and easily retrievable.

Calculation: Complex calculations required in insurance underwriting, pricing, and reserving can be automated with AI, improving accuracy and speed.

Repetitive customer service: AI chatbots and virtual assistants can handle routine customer inquiries and issues round the clock, improving service efficiency.

Simple product quotation: AI can instantly provide insurance quotes based on predefined criteria, making the process faster for customers.

Running actuarial models: AI can automate the execution of actuarial models, crunching large datasets to provide insights faster.

Filing: AI can automate the filing process, categorizing and storing documents accurately for easy retrieval.

Writing covernotes: AI can generate cover notes based on predefined templates and data input, streamlining the documentation process.

Tasks with AI Assisted Automation

Forming/testing hypotheses: AI can assist in data analysis and simulation, aiding insurance professionals in hypothesis testing and decision-making.

Medical diagnosis (for claims): AI can provide preliminary analysis of medical claims based on historical data and medical records, assisting claims adjusters.

Legal writing: AI can assist in drafting legal documents by providing templates and suggesting content, but human review is essential for accuracy and compliance.

Persuading/selling: AI can provide data-driven insights to sales teams, aiding in personalizing pitches and identifying cross-selling or upselling opportunities.

Managing others: AI can provide analytics on team performance and workflow efficiency, aiding managers in making informed decisions.

Decision making on complex claims: AI can analyze complex claims, providing data-driven insights to assist human adjusters in decision-making.

Insurance broker fact find: AI can automate data gathering and analysis, aiding brokers in understanding client needs and identifying suitable insurance products.

Developing/designing actuarial models: AI can assist in developing more sophisticated actuarial models by analyzing vast amounts of data for patterns and insights.

Installation/configuration of IoT devices: AI can assist in configuring IoT devices used in insurance for data collection and monitoring, ensuring they are set up correctly to provide accurate data.

The inclusion of Generative AI can significantly enhance the efficiency, accuracy, and data analysis capabilities in the insurance industry, enabling better decision-making and improved customer experiences.

Way Ahead

Building Trust Again: Insurance began as a way to help each other out during tough times. But as it got more organized, it became more distant and mistrustful. The companies wanted to pay less, and the customers always wanted to pay less too, but for more coverage. This made both sides wary of each other.

New Trends Emerging: Now, there are big trends changing this old scene. Technology and a sharing-friendly economy are bringing back the trust in insurance. It’s like going back to when helping each other was simple and direct, but with modern tools.

Being Ahead of Trouble: Insurance usually steps in after a problem, but now the focus is shifting to stopping trouble before it starts. Companies are using smart gadgets to help prevent issues like fires or health problems before they happen. This way, both the insurance company and the customer are on the same side, wanting to avoid problems.

Joining the Club: Instead of just being a customer, people are becoming members of insurance groups. It’s like being part of a club where everyone shares the risks and benefits. This way, people trust each other and the insurance process more.

Connecting Socially: Insurance is becoming more social and less transactional. People trust recommendations from friends more than ads from companies. So, insurance companies are moving into social circles, making the whole experience more friendly and engaging.

Tailoring to You: Insurance plans are becoming more tailored to individuals rather than being one-size-fits-all. With lots of data from various sources, insurance can now fit like a perfect suit, covering exactly what you need, when you need it.

Going Digital: The digital shift is making insurance simpler and more transparent. Companies like Lemonade are creating platforms where you can manage your insurance needs digitally, making the process swift and clear.

Global Outreach: The insurance world is expanding beyond local boundaries. New businesses are thinking globally, aiming to provide insurance solutions that can cross borders, making insurance a more accessible and streamlined service for everyone, everywhere.

How Can I Get Started to Drive Digital Transformation in Insurance?

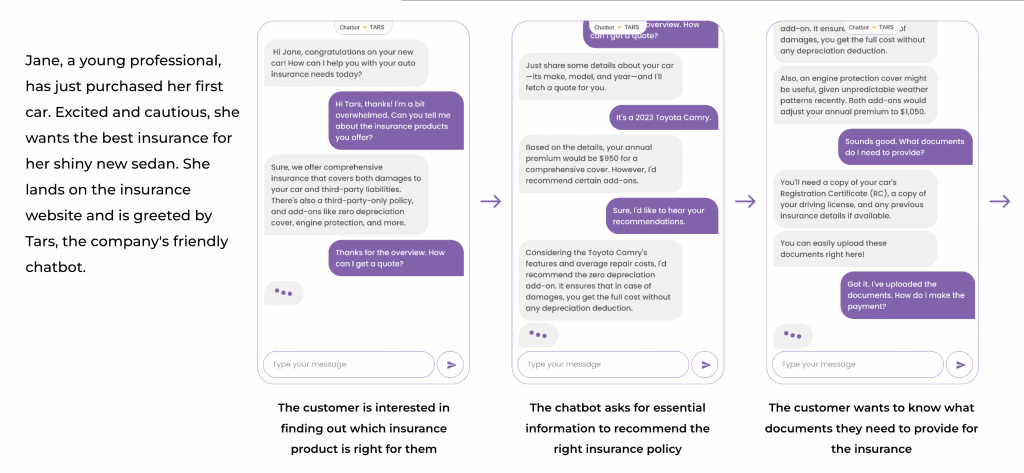

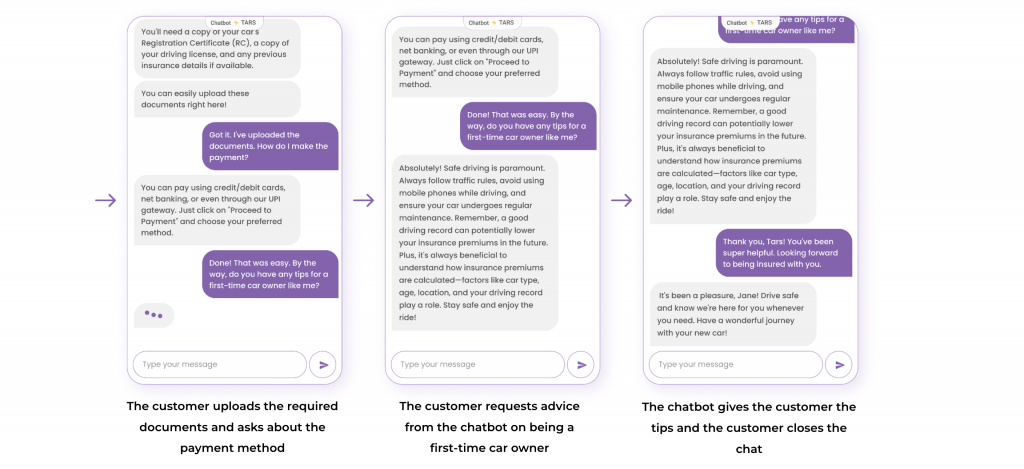

Embarking on an insurance journey can feel like navigating through a maze. Here, Tars emerges as a discerning guide, making each step of the journey clear and manageable. Let’s delve into how Tars simplifies the three pivotal stages of the insurance customer journey.

The Acquisition Stage

The Acquisition Stage is the maiden voyage for customers into the realm of insurance. It’s a vital juncture where information, understanding, and clarity steer the course towards making informed decisions. Tars, with its adept conversational AI, stands at the helm, ensuring a smooth sail. Let’s navigate through how Tars orchestrates this phase:

Product Inquiry:

In the vast sea of insurance products, finding the right one can be daunting. Tars casts a wide net to fetch instant information about various insurance products, coverages, and benefits, making the horizon clear for the inquisitive minds.

Quote Generation:

A prompt quote can set the sail in the right direction. Tars swiftly processes the details provided by the prospect, offering instant quotes that give a clear view of the cost compass.

Personalized Policy Recommendations:

Every voyage is unique, and so are the insurance needs. Tars delves into the waters of driving history, vehicle type, and other relevant factors to suggest policies that resonate with the individual needs of the prospect.

Documentation Assistance:

The first step onto the insurance boat requires a solid footing. Tars ensures that by guiding new customers on the documents needed, making the process of uploading or submitting them a breeze.

Payment Guidance:

The initial payment is the wind that sets the sail. Tars assists in maneuvering through the payment process smoothly and provides instant confirmations, ensuring a favorable wind for a good start.

Educative Interactions:

Knowledge is the compass. Tars engages in educative interactions, shedding light on safe driving practices, the essence of insurance, and the calculus of premiums, empowering the prospect with the knowledge to navigate the insurance seas wisely.

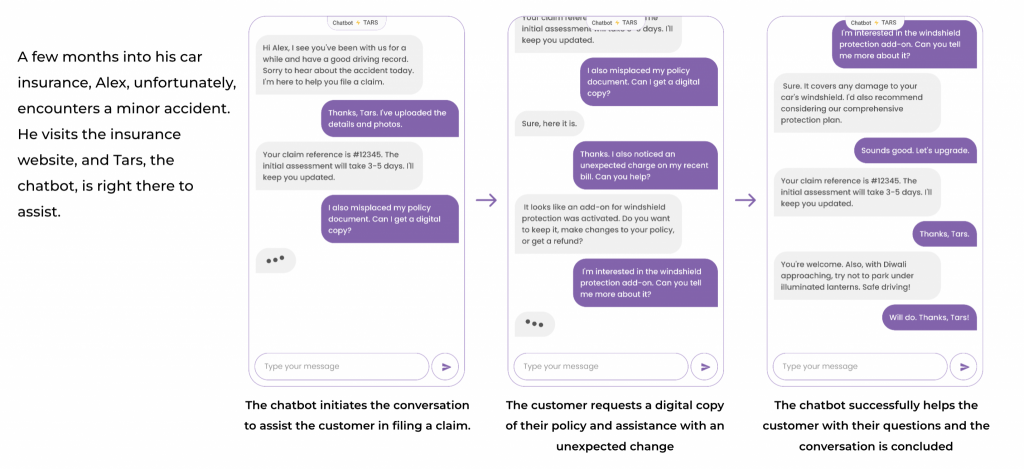

The Policy Management Stage

Claim Filing Assistance:

The storm of a claim can be daunting. Tars provides a guiding light, assisting policyholders through the claims process, detailing the necessary information, and outlining the subsequent steps to harbor safety.

Claim Status Checking::

Uncertainty can be like drifting in uncharted waters. Tars offers a reliable compass by providing customers the ability to check the status of their claims instantly, keeping them informed and at ease.

Document Retrieval::

Fetching vital documents should not be a voyage. Tars ensures smooth sailing in retrieving digital copies of policy documents, claims forms, or no-claim certificates with just a few clicks.

Feedback Collection:

Every interaction is a chance to smooth the sails. Tars seeks feedback after each interaction or claim process, making way for continual refinement in services.

Billing and Payment Assistance:

Regular premium payments are the steady winds that keep the policy afloat. Tars guides through the billing waters, providing clarity on billing statements and assisting in seamless payments.

Policy Changes and Upgrades:

Changing currents may call for a change in coverage. Tars assists those looking to amend details on their policy or upgrade their coverage, making the transition a smooth sail.

Emergency Assistance:

In the event of accidents or emergencies, a guiding hand is crucial. Tars offers prompt guidance, connecting to the appropriate channels when the seas get rough.

Notifications on Policy Changes:

Changes in policy terms or related regulations are like changing winds. Tars ensures policyholders are well-informed about any significant shifts, keeping their voyage on a steady course.

Personalized Customer Engagement:

A journey is memorable with a personal touch. Tars extends a warm engagement by sending tailored birthday and anniversary wishes, exclusive discounts, or loyalty perks. It underscores the insurer’s dedication by sharing valuable content, enriching the voyage of policyholders.

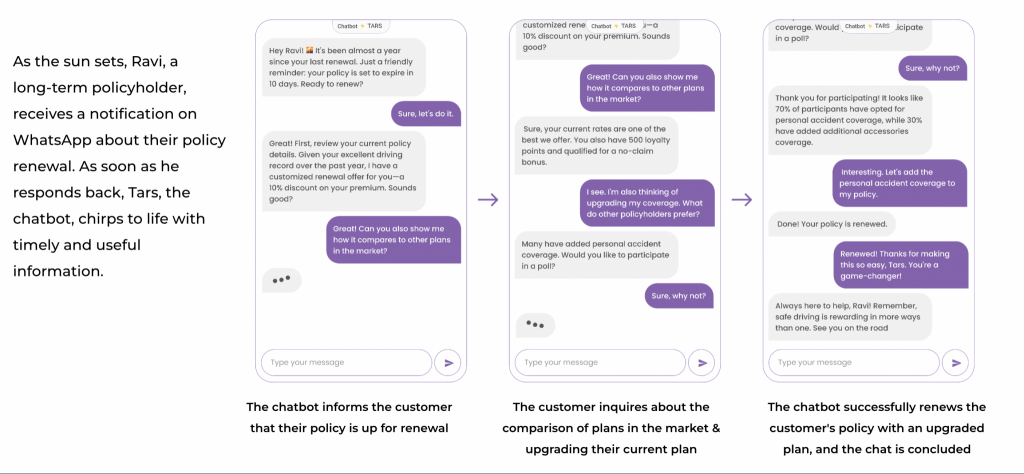

The Retention Stage

Proactive Renewal Reminders:

Tars sends proactive reminders about policy expiration dates, ensuring the voyage with the insurer continues unhindered.

Automated Renewal Process:

Renewing a policy can be a breeze. With Tars, the process is simplified through easy-to-follow steps via conversational AI, making the renewal process feel like a gentle sail.

Customized Renewal Offers:

Every voyage is unique. Tars offers customized renewal rates or discounts based on driving behavior and loyalty, making the journey with the insurer continually rewarding.

Loyalty Program Information:

The lighthouse of loyalty shines bright with Tars, informing customers about accumulated loyalty points, no-claim bonuses, and other treasures awaiting them.

Rate Comparison Tools:

In the vast sea of insurance, knowing one’s standing is vital. Tars enables customers to compare their current rates with other options, emphasizing the value they continue to receive.

Survey and Polling:

To keep the voyage on course, understanding the changing winds is crucial. Tars hoists the signal flags of surveys and polling to grasp if the policyholder’s needs have changed and what more they yearn for on this insurance voyage.

To make the most of your Insurtech journey, book a free automation consulting with us. We’ll guide you every step of the way, ensuring a smooth and efficient experience. Don’t navigate the complex world of InsurTech alone; let Tars be your trusted guide. Book your free consultation now!

Hello! I’m a problem solver at Tars, passionate about blending AI, design, and automation in the SaaS realm. With roles like Design Lead, Engineering Lead, and Writer at Hacker Noon under my belt, I’ve nurtured a mix of skills that drive innovation.

At Tars, I help companies automate customer support in both public sector and private enterprises, making processes smoother. My goal? To create solutions that not only answer today’s issues but anticipate tomorrow’s questions.

I share my insights on Large Language Models, Transformers and other emerging technologies at Hacker Noon, I also help startups communicate their visions clearly. I’ve learned that understanding users, showing empathy, and asking the right questions are the stepping stones to success.

I’m always open to connecting with professionals who share my excitement for technology and its power to change lives. If you’re curious about AI, design, or automation, feel free to reach out. Let’s create something impactful together! 🚀

0 Comments on "What is InsurTech and How It Drives Digital Transformation in Insurance"